Accounting and Bookkeeping

Accounts Receivable

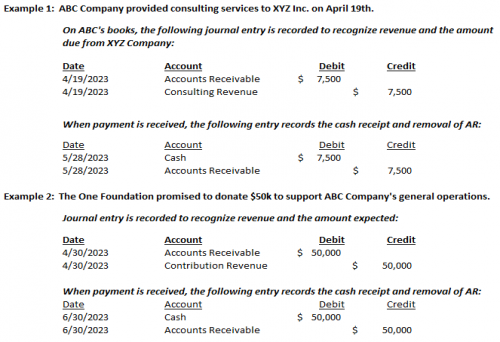

Accounts receivable (AR) is an asset account found on the Balance Sheet or Statement of Financial Position that represents money due to the organization from another party. Under the accrual basis of accounting, accounts receivable is recorded when revenue is earned (ex: services rendered, or goods sold) or a promise to give is received by the organization. Below are examples of journal entries that illustrate the AR lifecycle.

Effective management of accounts receivable is important to an organization’s cash flow management. The aging of accounts receivable accounts should be monitored on a regular basis for collectability, past due accounts, and impact on future cashflow.