Accounting and Bookkeeping

Cash vs. Accrual

There are two main methods of accounting an organization can use for recordkeeping: cash basis and accrual basis.

The main difference between cash and accrual basis accounting is in the timing of when revenue and expenses are recognized. Under cash basis accounting, transactions are recognized based on the movement of cash. Revenue is recognized when cash is received; expenses are recognized when cash is disbursed.

Under the accrual basis of accounting, revenue is recognized when earned and expenses are recognized when incurred, regardless of whether payment has been received or disbursed. This method follows the matching principle of accounting, where revenue and expense are captured in the period they were generated.

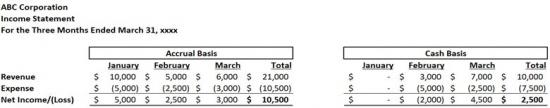

Below is an example that illustrates the difference between the two methods and the impact on the bottom line, i.e., net income. In this example, ABC Corporation had merchandise sales totaling $21k and $10.5k in expenses during January through March. They only collected $10k cash in customer payments and paid $7.5k in bills during this timeframe.

Under the accrual method income statement, revenue and expenses are recorded in the month they originated, regardless of payment status. Under the cash method example, revenue and expenses are recognized as cash is collected and spent. In our example, the difference between the two methods results in a significant variance in the revenue, expense, and net income totals for the organization. This is due to the timing gap between the sale/purchase and the receipt/payment of cash.

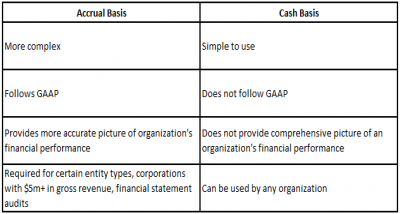

While the cash basis of accounting is a simpler method, accrual basis accounting presents a more accurate picture of an organization’s operating results because transactions are captured in real time in the period they occur. As can be seen in the example, it also reduces fluctuations in the monthly results caused by the timing of cash receipts and payments. This provides management and potential investors/funders with a more accurate assessment of the organization’s profitability, as well as the ability to forecast future cash flow based on the trending of sales and expenses.

It is important to note that while an organization can choose either method, GAAP (Generally Accepted Accounting Principles) requires the use of accrual basis accounting. The cash method, while simpler to use, does not comply with GAAP.