Accounting and Bookkeeping

Payroll

Payroll includes many components in addition to the wages paid to employees. It includes the computation and remittance of federal, state, and local tax liabilities associated with the wages, as well as the filing of tax returns and other documents required by the various tax agencies. Due to the complexity involved, it is recommended that payroll is outsourced to an external vendor to ensure compliance with the rules and regulations of the various federal and state-level tax authorities.

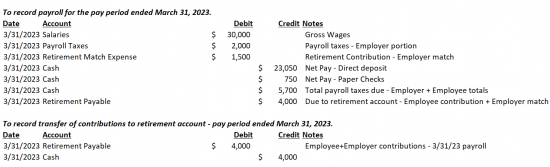

Recording payroll is not just showing the amount deducted from the bank account, but all components making up the amount. Payroll includes:

• gross salary

• both federal and state payroll taxes

• deductions for benefits (ex: health insurance, retirement contributions)

• net amount withdrawn from your organization's bank account

If an organization decides to offer direct deposit for its employees, the payroll-processing firm will withdraw both the net salary and payroll taxes (both employer and employee portion) from the bank account of the organization. If an employee is paid using a check, the payroll-processing firm will provide a printed payroll check for the net amount and only withdraw payroll taxes from the organization's bank account.

If payroll is outsourced, your payroll service provider will supply reports for each pay period including a payroll register for the current payroll period listing the pay detail by employee and a summary of total cash required for the pay period.

Below is a sample of a payroll journal entry: