Accounting and Bookkeeping

Petty Cash

Petty cash is a small amount of cash kept on hand to pay for incidental expenses such as cab fare or postage, where it is not convenient to use a check or credit card. Before a petty cash account is set up, the organization should establish a policy that dictates the maximum amount to be held in the account, types of expenses permitted, the maximum disbursement amount allowed, when and how much cash should be replenished, and the process for requesting and disbursing the funds.

Petty cash is typically funded by writing a check for cash at the bank. The cash is then held by the designated custodian and stored in a locked drawer or box. When petty cash is disbursed, the custodian prepares a slip or paper record that includes the date, amount, the requester, and the reason, along with any supporting documents (ex: receipts). Petty cash accounts, while small, require strong internal controls due to the risk of misappropriation or fraud. All expenses paid using petty cash should be recorded in the general ledger and the account balance should be reconciled to the general ledger balance on a regular basis (monthly or quarterly).

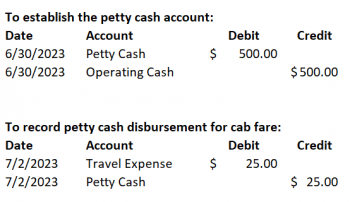

To account for petty cash transactions, journal entries need to be recorded in your general ledger. Below are sample journal entries.