About Us

Chart of Accounts

What is a Chart of Accounts anyway?

It’s part of your accounting architecture. It’s a series of line items, or accounts, that allows you to organize your accounting data. These line items pertain to your financial position (or Statement of Financial Position) and to your financial activities (or Statement of Activities).

Statement of Financial Position (SOFP) Line Items

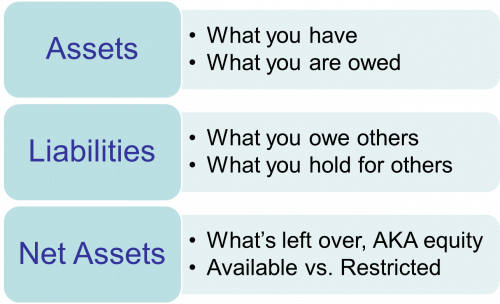

Statement of Position accounts are fairly standard. They roughly fall into three categories:

All three categories can include current and long-term items. These accounts are usually set up in the order of how liquid they are. Cash is usually first among assets, with property and equipment later. Accounts payable and credit cards precede long-term loans among liabilities. Available net assets precede net assets with donor restrictions.

Statement of Activities (SOA)

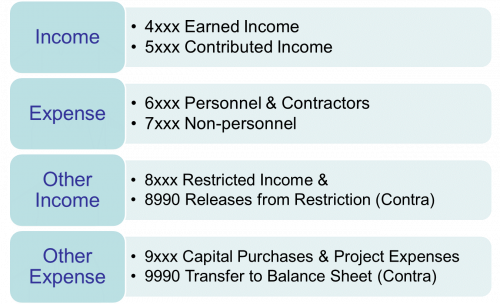

“Ordinary”, or revenue without restrictions, and expense accounts in QuickBooks can be used for “operating” accounts. Revenue accounts precede expense accounts. “Other” revenue and expense accounts can be used for other special, non-operating purposes.

The income and expense line items should be compatible with and easily crosswalk to various tax (990), regulatory, funder, and industry survey reporting requirements. However, line items should primarily serve the strategic reporting needs of the organization. Fortunately, these are not mutually exclusive objectives.

Revenue accounts are usually grouped as program, contributions or other and itemized by the source of the revenue e.g., ticket or tuition for earned, or local government, foundations, individuals for contributed, etc.

Alignment & Consistency

Planning (budgeting), accounting, and reporting must all be in alignment to usefully compare performance to budget and to enable making good decisions based on that data. Names used for line items in the accounting system should exactly match the budget line items. Program and accounting folks need to use the same language if there is to be accuracy and efficiency in planning, accounting, and reporting. Vague or inconsistent account names can lead to misalignment and confusion. Use clear names for your accounts that make it easy to understand what goes in each line-item.

How you set up your accounting system, including your chart of accounts, influences what your reports look like and whether the information you record and receive will enhance your board’s understanding of your finances, or confuse them.

A well-designed system that serves programmatic strategy and uses consistent terms and procedures puts all stakeholders on the same page and promotes accountability and good decision-making.

© 2021 Elizabeth Hamilton Foley