Nonprofit Accounting Basics

Cost Allocations: The Basics

For nonprofit organizations, implementing and clearly documenting a cost allocation methodology is essential. This methodology must be reflected in audited financial statement notes, internal policies and procedures, and often in communications with potential funders. If you're new to working with nonprofits, understanding how to approach cost allocation is a critical first step.

Understanding Cost Allocation

Cost allocation refers to the process of assigning a portion of shared or indirect costs—such as office supplies, rent, or IT support—to the various cost centers within an organization. These cost centers may include programs, departments, or physical locations.

Think back to your cost accounting coursework, where you learned methods for allocating shared costs in manufacturing or distribution settings. Nonprofits apply similar principles to understand the full cost of delivering programs and supporting services.

To allocate costs effectively, organizations must identify the “drivers” that best represent how shared resources benefit each area. Common allocation drivers in the nonprofit sector include:

• Labor distribution (by FTEs or salary dollars)

• Square footage (for occupancy-related costs)

• Number of program participants or beneficiaries

Example: ABC Nonprofit

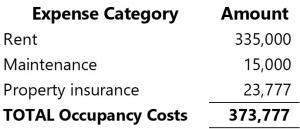

Let’s consider ABC Nonprofit, which provides technology training as its core program. The organization tracks its occupancy costs in the general ledger as follows:

ABC Nonprofit has determined that occupancy costs should be allocated based on square footage usage by department. The space allocation is as follows:

• Classrooms: 80% – Allocated to Program Costs

• Administrative Offices: 15% – Allocated to General & Administrative (G&A)

• Computer Storage: 5% – Allocated to Program Costs

Based on this allocation, the occupancy costs are distributed as:

• Program Costs:

• Classrooms (80%): $299,022

• Computer Storage (5%): $18,689

• G&A:

• Administrative Offices (15%): $56,066

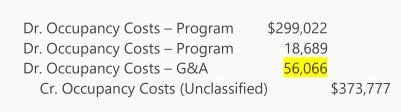

These allocations can be recorded manually or through accounting software. If using a system like QuickBooks that lacks built-in allocation features, a journal entry might look like this:

Note: The bolded G&A allocation will be used in a subsequent step.

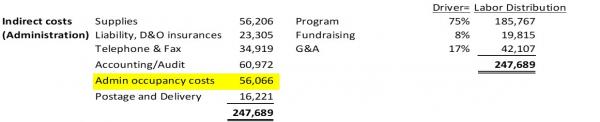

Multi-Step Allocations

In many cases, cost allocations involve multiple steps. For example, the G&A portion of occupancy costs may later be reallocated to programs and fundraising activities using a different driver—such as labor distribution by FTEs, as illustrated below:

ABC Nonprofit uses FTEs to allocate its total G&A (indirect) costs. After the initial occupancy allocation, the organization calculates and distributes its total G&A expenses accordingly.

Organizations may choose to allocate by natural expense account or through a consolidated account (e.g., “Indirect Cost Allocation”). The method selected should align with the organization’s reporting needs and accounting practices.

Considerations for which approach to use include:

• Line by line allocations, while more labor intensive, provide much better transparency into the relative spending by cost center. This provides better information to support better decision-making by report users.

• It also aligns closely with best practices and is often preferred by potential funders as well as by charity watchdogs like Charity Navigator.

• If your accounting system has a cost allocation feature, this can lighten the burden. If not, line by line allocations take a bit of time to set up in Excel, but once achieved, they can be made very efficiently through thoughtful use of data upload templates for your particular software.

Best Practices for Cost Allocations

• Consistency is key: Apply the same allocation methodology across all programs, funders, and cost centers.

• Reflect true costs: This will identify shortfalls that the development team can work to cover or notify management that they may want to renegotiate an award budget.

• Comply with funder requirements: For federal or government grants, consistent and well-documented allocation methods are essential to demonstrate that funders are covering only their fair share of indirect costs.

• Chart of accounts structure: Group costs by allocation driver to streamline the process and improve reporting accuracy.

Conclusion

A well-designed cost allocation plan provides nonprofit leaders with the financial insight needed to make informed decisions. It also ensures transparency and compliance with funder expectations.