Nonprofit Accounting Basics

Contributed Nonfinancial Assets Presentation and Disclosures

New disclosures are required upon implementation of Accounting Standard Update (ASU) 2020-07, which was issued by the Financial Accounting Standards Board (FASB) to increase transparency of contributed nonfinancial assets through enhancements to presentation and disclosure.

Contributed nonfinancial assets are also known as, and may be labeled as, gifts in kind, donated goods and services, and in-kind contributions.

Donated securities are not considered contributed nonfinancial assets.

Cryptocurrencies are considered nonfinancial assets.

Required Presentation and Disclosures:

• Presentation - Separate line for contributed nonfinancial assets on the statement of activities

• Disclosures required prior to ASU 2020-07 implementation:

1. Description of program or activity in which the goods or services were utilized

2. Amount of revenue recognized including nature and extent of the contributed services received

3. Fair value of contributed services received, but not recognized, if practicable (encouraged, but not required)

• Enhanced disclosures after the implementation of ASUS 2020-07 include the above and:

1. Contributed nonfinancial assets segregated by category / type of contributed nonfinancial asset

2. Whether the contributed nonfinancial assets were or will be monetized and if so, the related policies

3. Whether any of the contributed nonfinancial assets have donor-imposed restrictions and if so, a description of those restrictions

4. Description of the valuation techniques and inputs and principal market used to arrive at the fair value, if the principal market is a market in which the recipient is prohibited by a donor-imposed restriction from selling or using the contributed nonfinancial asset. (Otherwise, principal market information is not required to be disclosed, but may be if relevant to the valuation.)

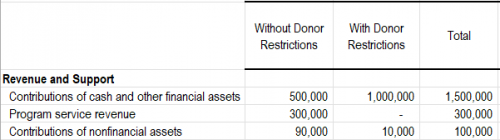

Sample Presentation - Statement of Activities:

Note that use of the term “Contributions of nonfinancial assets” is not required. Other terms such as “Contributions in Kind” or “Donated Goods and Services” are also acceptable.

Sample Contributed Nonfinancial Asset Policy Disclosure:

(Include as a section of the Summary of Significant Accounting Policies disclosure)

Contributed Nonfinancial Assets

Contributions of nonfinancial assets are recognized as revenue and expenses on the accompanying statement of activities at their estimated fair value at the date of receipt. Donated services are recognized as contributions if the services (a) create or enhance non-financial assets or (b) require specialized skills, are performed by people with those skills, and would otherwise be purchased by the Organization.

Sample Contributed Nonfinancial Asset Disclosure:

(Separate disclosure on contributed nonfinancial assets) (Note that either table or narrative formats are acceptable)

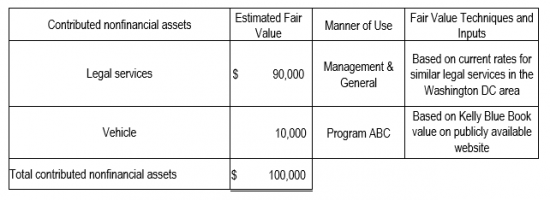

Contributed Nonfinancial Assets

The following table summarizes contributed nonfinancial assets that the Organization received by major category for the year ended December 31, 20XX:

Contributed nonfinancial assets are presented on the accompanying statement of activities. No contributed nonfinancial assets were monetized and there were no donor-imposed restrictions on the contributed nonfinancial assets during the year ended December 31, 20XX.

Additional Disclosures in the Year of Implementation:

• Include a disclosure on the adoption of a new accounting policy in the accounting policies note.

• If comparative financial statements are presented, both years’ disclosures must conform to the new ASU as it requires retrospective application.

Related Master Glossary Definitions:

Nonfinancial Asset: Nonfinancial asset An asset that is not a financial asset. Nonfinancial assets include fixed assets (such as land, buildings, and equipment), use of fixed assets or utilities, materials and supplies, intangible assets, and services.

Specialized Skills: Services that require expertise that are not possessed by most members of the general public or that require an individual to be licensed to practice the profession or craft.

Most Advantageous Market: The market that maximizes the amount that would be received to sell the asset or minimizes the amount that would be paid to transfer the liability, after taking into account transaction costs and transportation costs.

Principal Market: The market with the greatest volume and level of activity for the asset or liability.