Nonprofit Accounting Basics

The Importance of Cash Projections

It is a prudent financial practice to prepare and operate from a budget. The budget is the annual financial plan for carrying out the strategic plan and mission of the organization. It is usually prepared using the accrual method of accounting and in the same format as the financial statements, as it is included in the monthly financial reports to monitor the financial progress of the organization during the year.

While the budget is critical in maintaining or improving the financial stability of the organization, it fails to plan and monitor the organization’s ability to meet its cash requirements. The assumption is usually if the budget is balanced, all is well. Unfortunately, that is not necessarily the case as the accrual method of accounting does not measure cash flows, but rather the earnings and expenditures as services or goods are provided. Oftentimes, cash is received and spent at a different time which could expose the organization to cash shortfalls during the year.

Prior to the pandemic, this may not have been an issue for most organizations. However, in the past year(s) this has become a more important topic of conversation among nonprofit boards, finance committees, and management. Not only because cash inflows have been challenged, but also because organizations have become more prudent about setting aside reserve funds for long-term needs.

Even with the volatility of the market, many organizations continue to invest to help ensure their long-term stability, whether it’s to fund future projects, operations, or for a “rainy” day. Prudent financial practices call for investing excess funds whether it’s for short-term or long-term needs. Without a proper cash projection, the organization cannot accurately predict when it will have a shortage or excess of cash which should be invested. As a result, when there is an unexpected shortage, management must spend extra time juggling cash and vendors who want to be paid; alternatively if there is an excess, the earnings potential of that cash is not maximized.

No matter what your situation, there are several reasons for preparing and monitoring cash flow projections, including:

- Providing a leading indicator of financial stability or instability.

- Ensuring there is enough cash available to operate efficiently.

- Enabling an organization to maintain good credit by paying obligations in a timely manner.

- Allowing the organization to take advantage of long-term investment earnings.

Methods of Preparing Projections

Unless the organization chooses to track its transactions both on the accrual method of accounting (considered a best practice) and the cash method, which requires double the work and cost, preparing cash projections can be a daunting task. There is no one-size-fits-all method available. To determine the method of preparing and presenting the cash projection, one should consider the following questions:

What are the objectives of the cash projection?

For most organizations, the objective of a cash projection is to determine when a cash shortage or excess will occur during the year so decision-makers know when to transfer funds to or from short-term investments. Rather than waiting until the accounting staff realizes there isn’t enough cash to cover that week’s checks, a cash projection gives management the ability to anticipate this need, so they can be proactive rather than reactive.

Other organizations use a cash projection to not only anticipate when to transfer funds, but also to determine what is causing an excess or shortage. Is it due to timing, lower-than-expected registration for the annual conference, slow payment of dues, or worse yet loss of members, etc.?

These differing objectives will impact the method used.

How detailed does the projection need to be?

There are different levels of detail that can be projected:

- Cash balances,

- Cash inflows, outflows, and balances for the overall organization, and

- Cash inflows and outflows by program.

The first level simply provides management and the board with information about when an excess or shortage of cash is expected, while the second level provides information on the cyclical nature of its cash inflows and outflows. The third level provides more in-depth information about the impact the cyclical nature of each program has on the cash flow of the organization.

No matter which level of detail you choose, your cash projection should also be prepared in a way that enables you to compare projected and actual cash flow. In cases where there is a significant variance between the projected and actual cash flow, having this level of detail will help you determine the cause of the variance and make adjustments so you are able to adjust future projections as needed.

What is the best guide for determining cash flows?

Just like budgets are a guide to which variances need to be anticipated, cash projections are also a guide to variances that should be expected. Therefore, it should be prepared carefully using the appropriate guides and assumptions. For instance:

- Do we expect the historical cash inflows and outflows to be repeated?

- Are our department managers good at estimating when the cash will be received or disbursed based on their budgets?

If the answer to both is yes, they can be a good base upon which the cash projection is prepared. If the answer to only one is yes, use that one as your base for the cash projection.Methods of Presenting Projections

The presentation of the projection is just as important as the preparation of it. Usually simplicity is the best approach. Below is an example of a presentation we have found to be useful.

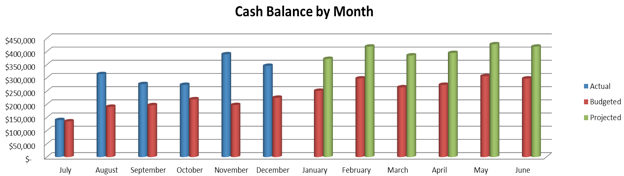

A simple chart that shows budgeted (based on the annual budget adjusted to cash basis), projected, and year-to-date actual cash balances provides management and the board with the information they need to manage cash. This chart only requires an organization-wide annual budget and historical cash flow information to be prepared. In this specific example, the projection was updated through the middle of the organization’s year due to an unusual and unexpected increase in member participation at events, resulting in a positive increase in cash.

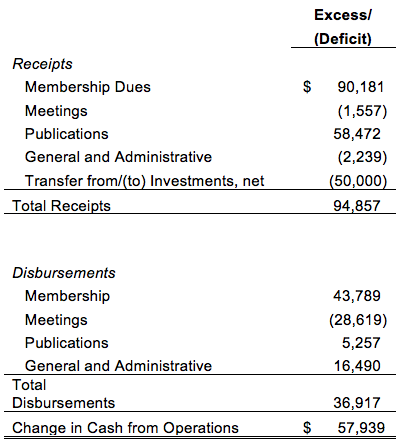

Below is a further analysis chart prepared to provide details of the variance in the actual vs. what was projected by program. In order to prepare this, the cash projection needs to be prepared and updated at the program level.

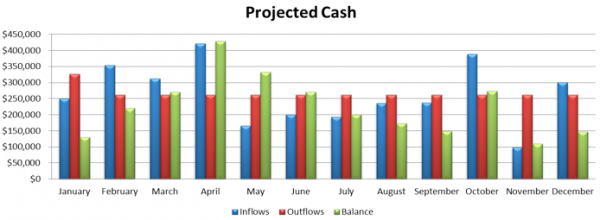

The following chart can be prepared to show the details of cash inflows, outflows, and balances. This too only requires an organization-wide budget distributed by month and historical cash flow information to be prepared.

Conclusion

Cash flow projections have become more important to the management and boards of nonprofit organizations over these past years. There are many different approaches used in preparing these projections, all are dependent upon the needs of the organization and its leaders, the nature of the organization, and its resources. In preparing your organization’s projections, it’s important to keep in mind the factors discussed above so you can make sure the approach used will provide management with the most useful information to make its decisions.