About Us

Chart of Accounts-Expenses

An organization’s operating expenses comprise labor, services, or things you buy or spend resources on to accomplish mission activities and to manage the organization. For small and midsize nonprofits without overly complex systems, 4-digit account numbers are usually adequate. Longer numbers can certainly be used, but that requires more keystrokes and may be harder to remember.

Expenses are not activities! Expenses are WHAT you spend resources on. Activities are WHY you spend the resources. You need to know both things, but your expense line items should reflect WHAT you buy or invest in. Unless your accounting software’s activity coding is based on numbering rather than a separate data field (activity class), please try to avoid using expense accounts to indicate program activities – i.e., a postage account for program 1, for program 2, for administration, and for fundraising. These redundant accounts offer opportunities for miscoding.

Expenses broadly fall in the categories of personnel or non-personnel. Your organization’s accounting structure should crosswalk to compliance reports (regulatory & industry reporting requirements or surveys) but should primarily serve the strategic reporting needs of the organization.

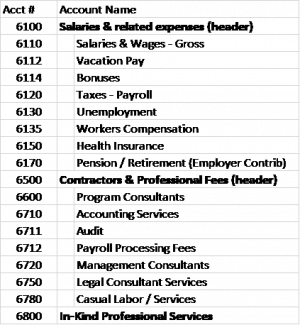

Personnel Expense Accounts

Personnel expenses include both salaried/hourly employees (W2) and contractors /consultants (1099) categories, plus donated professional services. Numbering for personnel accounts usually begins with 6.

Some organizations have a separate salary account for the executive, but that information is usually easily obtainable from your payroll service.

Please do not create a salary account for each position. For the same reasons you would not create separate income accounts for each foundation that gives you a grant – your COA will get too cluttered and there will be too many changes.

You can add sub-accounts for program and management contractors, but do that only if they are fairly generic and consistent, e.g., instructors, counselors, finance, fundraising, communications, etc. Your budget workbook should contain that detail rather than your accounting system.

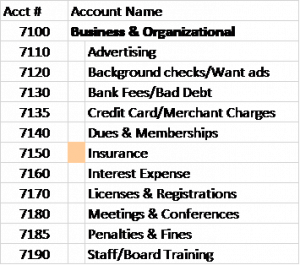

Non-personnel Expense Accounts

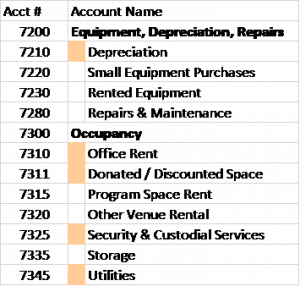

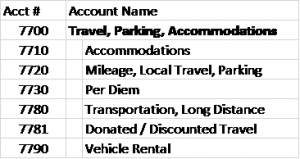

It can be convenient to cluster non-personnel accounts in logical groups of related expenses under a descriptive header such as business, equipment, occupancy, office, and travel, with numbering beginning with 7. This allows the related expenses to be rolled up into a summary report that shows less detail for certain report audiences (such as general board members, funders, and public) who may not need, or in fact may be overwhelmed by, the level of detail that is more appropriate for staff program managers and the finance committee.

Some operating expense accounts might be considered a common cost, that is, an expense that benefits the entire organization. A share of these costs should be assigned to each program and support activity based on an approved allocation methodology. In the example account clusters below, typical common costs are indicated with an orange highlight.

<< The business and organizational accounts are for the expenses it takes to run the governance business aspects of the organization.

Notice that each account in this cluster starts with 71… and that the accounts are essentially in alpha order within the cluster. This helps in locating the accounts and can speed up data entry.

The equipment and occupancy accounts are fairly self-explanatory. >>

Equipment with a useful life of less than a year and that costs below the board-established capitalization threshold would be assigned to account 7220.

Note how many of these accounts might be considered common costs – an investment of resources that proportionally benefits, and is necessary to, all activities of the organization.

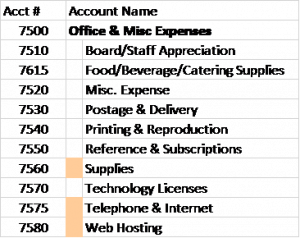

<< The office and miscellaneous accounts are also self- explanatory.

These expense line items can be direct costs (one program), shared costs (more than one program), or common costs (benefitting all programs proportionately).

“Technology Licenses” may be where you might assign the expenses for “software as service” subscriptions, such as customer relationship management, cloud storage, accounting, graphics, etc.

Not all of these travel accounts may be relevant to your organization. >>

There can be confusion re: where to record conference expenses – are the fees for attending the conference in the “Meetings & Conferences” account or the “Staff Development” account while the travel expenses are in travel? It’s best to make a decision about this when you are budgeting for these expenses, and the to be consistent between the planning (budget) and how they are recorded in the accounting system.

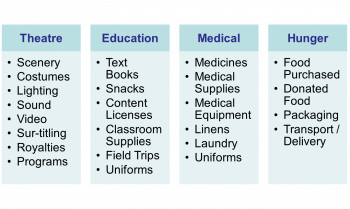

Some groups may want to budget for and track program expenses that are specific to their program implementation. This expense cluster could be numbered 76xx. Some examples include:

It is advisable for the organization to set up the accounts it needs to do good planning and to provide performance to budget data for these items.

It can also help with return on mission analysis and cost per unit calculations.

Other Expense Accounts

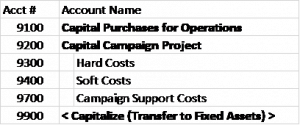

Some accounting software systems allow for “other income” and “other expense” type accounts to be created. These are especially useful to segregate restricted activity from unrestricted, and capital expenses from “ordinary” expenses. The following “other expense” type accounts can be set up for tracking capital expenses for operations (equipment purchases over the capitalization threshold) or for a large capital campaign project. Other expense accounts would be numbered in the 9-thousands.

The 9100 account would be used for one-off purchases to support operations such as computers, copiers, sound systems, etc.

More sub-accounts can be added to the capital campaign project costs for hard and soft costs and for campaign costs as the project warrants.

The 9900 account “transfer to fixed assets” account is another “contra” account. Rather than recording capital expenses straight onto the balance sheet in internal financial statements, you can run them through the Statement of Activities to show the use of funds to make the purchase, allow for performance-to-budget comparisons, and to assign (tag) them to specific campaign contributions.

At the end of each month, the amounts that can be “capitalized” are moved to the balance sheet into fixed assets. This is done via a journal entry crediting the 9900 account to reduce the capital expense, since expenses have a natural debit balance. The other half of the entry debits (increases) the relevant fixed asset account on the balance sheet. When appropriate, as noted above, the capital expense can also be assigned (tagged) to a grant supporting the purchase so it will show up as a grant expense in the memorized grant report. The entry to capitalize the asset wound not be tagged to the grant.

Your accountant will know which of these accounts you actually need, and whether additional expense accounts may need to be added.

See also: Sample COA ~ Small-midsize Nonprofits .

© 2021 Elizabeth Hamilton Foley

This information is provided for small and midsize nonprofit organizations for educational purposes only. It is not comprehensive and should not be considered legal or accounting advice on any specific matter. The user of this template/sample is responsible for tailoring the contents to meet the specific needs and circumstances of the organization.