About Us

Chart of Accounts-Liabilities

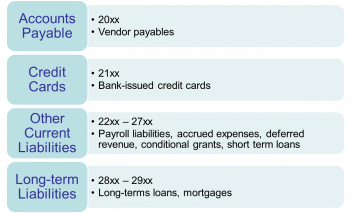

Liability accounts reflect what you owe to others and what you hold on others’ behalf. For small and midsize nonprofits without overly complex systems, 4-digit account numbers are usually adequate. Longer numbers can certainly be used, but that requires more keystrokes and may be harder to remember. Liability account numbering usually begins with 2.

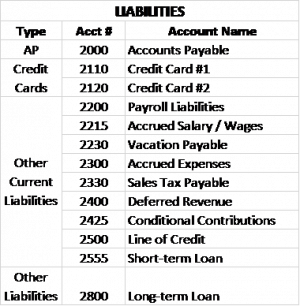

Here is a sample set of Liability accounts for a small-midsize organization:

• Accounts payable are the bills your organization must pay. Bills are entered as payable when the expense is incurred.

• Credit card expenditures are recorded per purchase. The balance is reduced as payments are made. The account is reconciled to the statement monthly, just like a bank account.

• If your organization uses a payroll service (recommended as a good risk management choice), ideally there will be no payroll liabilities, since they are handled directly through the service.

• The accrued salary / wages account is usually used annually in accrual accounting to ensure these expenses land in the right fiscal year.

• Vacation payable is used to accrue the value of unused leave for eligible employees, usually updated annually or upon termination of an employee.

• The accrued expenses account is used to estimate expenses for which a bill has not been entered, to ensure the expense is counted in the right fiscal year.

• For organizations that sell tangible items, your state or locality may require you to collect and remit sales tax. This account is used to record the tax as it is collected; the account is reduced when the tax is remitted to the locality.

• Deferred revenue is income, usually program-related earned income, collected in advance for services to be delivered in a future period, for example, tuition for classes, season tickets for a concert series, or conferences. If these services are not rendered, the cash may need to be refunded, so the income is not moved to the P&L income account until it is actually earned. This account serves the accrual accounting purpose as a holding place to align (recognize) income with related expenses with the same fiscal period.

• Similarly, refundable advances, may need to be returned if the conditions are not met. Income is recognized when services are provided.

• As part of its cash management strategy, an organization may negotiate a working capital line of credit or enter into a short-term loan agreement with an institution or individual. The principal amount borrowed is reflected in these liability accounts, while any interest paid is recorded as an operating expense.

• A long-term loan would be for a note or mortgage that was payable over many years.

Your accountant will know which of these accounts you actually need, and whether additional liability accounts may need to be added. See also: Sample COA ~ Small-midsize Nonprofits .

© 2021 Elizabeth Hamilton Foley

This information is provided for small and midsize nonprofit organizations for educational purposes only. It is not comprehensive and should not be considered legal or accounting advice on any specific matter. The user of this template/sample is responsible for tailoring the contents to meet the specific needs and circumstances of the organization.