About Us

The Disaggregated Statement of Financial Position: Recommended Internal Report Format

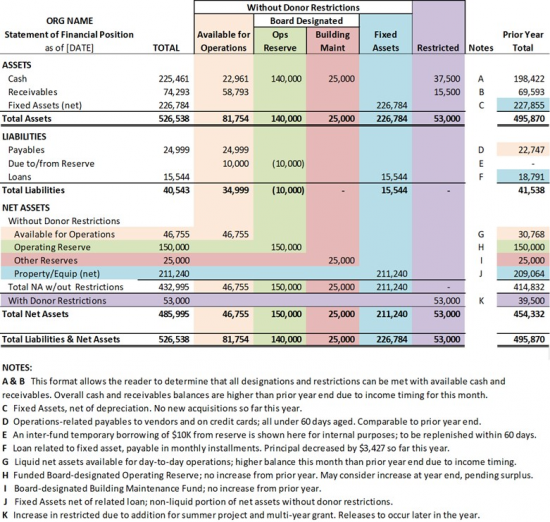

A well-formatted Statement of Financial Position (SOFP) report provides accurate and relevant information with enough context for the board and other stakeholders to thoroughly understand what’s going on with your organization financially. The most useful SOFP reports include columns showing restricted and designated funds separately from unrestricted. They include a prior year comparative and narrative that explains the contents of each line item and any significant changes or unusual balances. (See also Statement of Financial Position.)

The illustration below shows is a disaggregated format for a Statement of Financial Position recommended for internal reporting purposes, which will provide stakeholders with additional information beyond what is required for audit and other reporting purposes. This model has the advantage of clearly showing that net assets with donor restrictions and/or board designations have liquid assets such as cash and/or receivables in excess of the amount needed to meet the restrictions.

Further, the model shows net assets without donor restrictions separately from non-liquid investments in property and plant as these assets are not available to pay for day-to-day operations. The report for your organization might include more detailed line items in each category, but the objective would be to not exceed one page in length. Notes are alphabetically keyed to corresponding narrative shown below the numbers. Color-coding is a choice that may also assist the reader.

The line-item totals in the first column are split apart into mini-SOFPs, if you will, in the columns to the right. This separation provides a better understanding of their composition. For instance, in a single-column SOFP showing only the line-item totals, a reader might think that $225,000 is a good amount of cash. But, only by teasing it apart does one see that working capital cash is pretty low at the moment, even including $10,000 that was borrowed from the Operating Reserve. The use of the reserve would be recorded internally as a transfer of funds from the savings account to the operating checking account, presuming the reserve is housed in a separate savings account as recommended. See our section on the Nonprofit Operating Reserves Initiative (NORI) under Fundamentals.

Operating liquidity is indicated in the Operations column. This allows the organization to easily monitor the portion of its Net Assets Without Donor Restrictions that is available for operations. It is important for an organization to strive to keep this balance positive, as a negative balance would indicate serious financial stress. Note that an organization can have a high positive total balance for Net Assets Without Donor Restrictions, but if that total includes a substantial investment in non-liquid property and plant, the organization may be “house poor” and its ability to implement mission programs may be compromised. That is why the board approved investment in property & plant is shown separately as a non-liquid portion of assets and net assets to distinguish it from day-to-day operations activity that requires positive liquidity. Likewise, in other columns a reader can see that Net Assets with Donor Restrictions can be met with available cash and/or receivables in the last column.

The board has designated both an Operating Reserve ($150K) and a Building Maintenance Fund ($25K) as seen in the two net assets lines for the designated reserves. In this example, as noted above, $10K has been borrowed from the Operating Reserve. Up in the cash line, there is only $140,000 in the board-designated Operating Reserve column, $10K less than $150K, as $10K was moved into the Available for Operations column when it was borrowed.

That doesn’t mean it became undesignated, just borrowed. The Due to/from Reserves line, just under Payables, shows how much was borrowed as a positive amount in the Operations column and as a negative in the Operating Reserve column, to keep the mini-SOFPs in balance. Additional narrative in a treasurer’s report would explain the specific reason funds were borrowed and the expected timing on replenishment, etc.

No accounting software, particularly ones in the price range of most small and midsize nonprofits, can produce a “canned” report with as much context and analysis as the above. This report is formatted in a spreadsheet and raw data are exported from the accounting software and inserted or linked into the preformatted report for the year-to-date total. Separating the totals into the various columns is a management task done directly in the spreadsheet, unless the accounting software has the capability to do it.

Return to the Internal Reports Introduction page for links to greater detail on how to read various reports as well as recommended formatting.