About Us

Reporting on Expenses For Small and Midsize Nonprofits

The Statement of Activities (SOA) is the correct nonprofit term for what we may have commonly called the income statement, budget report, profit & loss, income and expense report, etc. The SOA shows the nonprofit organization’s revenue, expenses, and net revenue (surplus or deficit) for a specific period of time, all or part of a fiscal year.

Expense Line Items

It is important to have the accounting line items in your accounting software match the line items in your budget template. This is especially true for expense line items. Misalignment between budget and accounting line items necessitates tedious regrouping of numbers for budget comparison reports and can lead to over-spending of accounting line items not represented in the budgeting process. Make an effort to ensure that the program and finance staff use the same line-item names to mean the same thing – this may take some negotiating. The best practice for greatest accuracy is to name line items clearly with commonly understood word meanings rather than to use jargon or vague names subject to interpretation.

Detailed line items can be grouped to allow for summary reporting, for example:

• Salaries and Related Expenses (gross salaries, payroll taxes, unemployment, health/other insurance, workers comp, retirement, etc.)

• Contractors and Professional Fees (program contractors, consultants, accountants, lawyers, etc.)

• Business and Organizational (bank and credit card fees, interest, insurance, filing fees, staff development and recruitment, advertising, etc.)

• Equipment, Depreciation, and Repairs (observe capitalization thresholds for purchases)

• Occupancy (rent, utilities, security, custodial, refuse, etc.)

• Office and Miscellaneous (postage and shipping, printing and copying, telecom and Internet, website maintenance, software licenses, etc.)

• Travel, Parking and Accommodations (local and long distance, vehicle rentals, etc.)

If specialized supplies and materials are needed to conduct programs, you may also want to have a grouping for Program Specific Expenses. For instance, a theatre group may want to budget for and track expenses for costumes, scenery, lighting, sound, etc. or a community service organization may want to track food, shelter, and medical expenses.

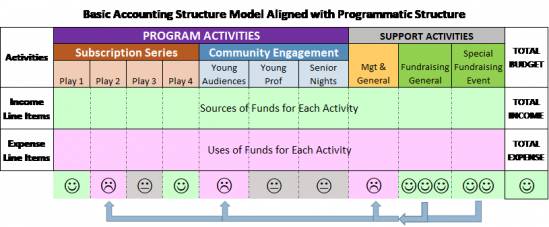

Functional Activity Classes

Generally Accepted Accounting Principles (GAAP) and the IRS 990 require nonprofit organizations to allocate expenses among three activity classes: program, management, and fundraising. Organizations with more than one program may wish to assign direct and shared expenses across several programs for a better understanding of their business model.

Assigning expense line items to activity classes allows an organization to know both what its resources are being spent on and for what purpose. Board and management can later analyze the return on mission for each activity. How much is being spent on the activity vs. the income it attracts, and how relevant the activity is to core mission. Bear in mind that high mission-relevant programs may not always be the biggest money makers.

Return to the Internal Reports Introduction page for links to greater detail on how to read various reports as well as recommended formatting.