About Us

Cash Flow Projections

How much cash do we have? How much cash will we have? Is there a point where we may run out? What can we do about it now? These are questions an organization’s board and management will be able to address if they make the effort to budget for and project cash flows.

Cash Flows in the Audit

The Statement of Cash Flows report is a required component within an organization’s audit per GAAP (generally accepted accounting principles). It reflects the changes in account balances on the Statement of Financial Position (SOFP) related to operations, investing, and financing, since the beginning of the fiscal year. Some readers may find the format of this report difficult to understand and less useful because it is not forward-looking.

Budgeting for Cash Flow

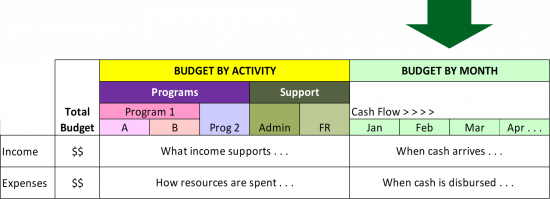

For internal reporting purposes, projecting cash flow is important for small and midsize nonprofits. To create a useful internal Cash Flow Projections report, a good place to start is during the budget process, since the budget itself is, essentially, a projection. During the budget process, in addition to allocating income and expense line items to program and support activities, also spread the budget for each line item by month. When will the cash for the budgeted income arrive? When will the cash be spent for the budgeted expenses?

Some regular expenses like salaries and rent may be spread evenly over twelve months. Other expenses, and many revenue sources, may vary significantly by month. It may require some research and analysis of past timing to inform the budget estimates for those items. The month-by-month estimates will become the inflows and outflows for the cash flow projections.

Internal Cash Flow Projections Report

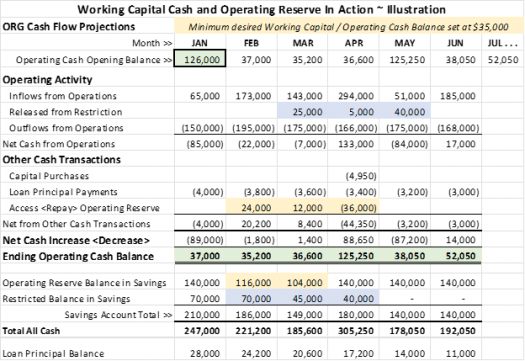

A Cash Flow Projections report begins with the opening cash balance, adds cash inflows, subtracts cash outflows, and shows the resulting cash ending balance. Because the budget-by-month will only show the inflows and outflows related to operations, the cash flow projections report will also need to include a section for other cash transactions. Below is a basic cash flow projection model showing inflows and outflows from operations along with examples of how cash is affected by non-operating cash transactions.

This organization established a minimum balance that it would like to maintain in its operating account for day-to-day operations. They began the year with $126,000 in operating cash. (Note that in this model, donor-restricted funds and the board-designated operating reserve cash are kept in a separate savings account.) Because of the timing of inflows from operating, net cash from operations is negative from January through March, reducing the cash in the operating account.

In the Other Cash Transactions section, you can see how the organization anticipated and handled the low cash balance in February. They show a temporary use of operating reserve funds to maintain the established minimum in the Ending Operating Cash Balance; they restored the borrowed cash to the reserve in April. This model also shows the transfer of restricted funds from savings to checking as the funds were released from restriction, partly in March and fully by May. This section also shows the cash impact of loan principal payments as well as a capital purchase planned for April.

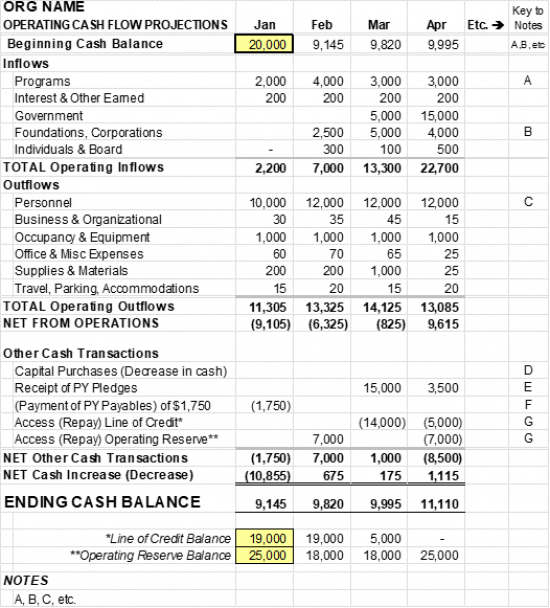

Your organization may want to show more, or other, details in its report, including the use of a bank line of credit and different subtotals. Here is another possible model:

Whatever the model, the principles remain the same, and the advantage of seeing what’s coming and preparing in advance for how to handle cash fluctuations is key to good financial management. It’s a powerful tool for communicating that the organization can think ahead. For instance, it can show a regular funder when cash flow is chronically low and persuade the funder to adjust its grant cycle to smooth out the low months.

Return to the Internal Reports Introduction page for links to greater detail on how to read various reports as well as recommended formatting.